Sachin Tendulkar, the former cricket legend who has been a Member of the Upper House of Parliament and members of his family, figures in the Pandora Papers as the beneficial owner of an offshore entity in the British Virgin Islands (BVI) which was liquidated in 2016.

Millions of leaked documents dubbed the Pandora Papers. A worldwide journalistic partnership on Sunday claims to have uncovered the financial secrets of current and former world leaders, politicians, and public officials in 91 countries and territories, including India.

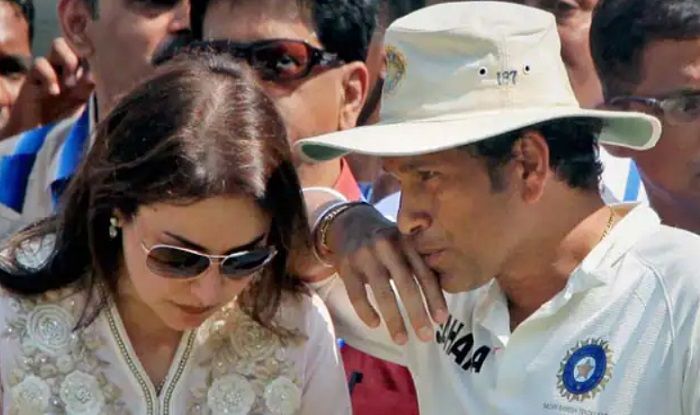

Sachin Tendulkar, Anjali Tendulkar, And Anand Mehta Were Named As BOs And Directors Of Saas International Limited

Sachin Tendulkar, with his wife Anjali Tendulkar and father-in-law Anand Mehta, as per an investigation of Panama law firm Alcogal which are part of Pandora Papers, are named as follows: BOs and Directors of a BVI-based company: Saas International Limited. The data is part of documents from Panamian law firm, Alcogal, with their company being incorporated by LJ Management (Suisse).

According to the ICIJ, Pandora Paper’s secret documents expose offshore dealings of the likes of the King of Jordan, the presidents of Ukraine, Kenya, and Ecuador, the Prime Minister of the Czech Republic, and former British Prime Minister Tony Blair. The files also reveal the financial activities of Russian President Vladimir Putin’s “unofficial minister of propaganda” and more than 130 billionaires from Russia, the US, Turkey, and other nations.

Saas International’s first reference in the Pandora records dates back to 2007. The most detailed set of documents, along with financial benefits for the company’s owners, are available from the time of liquidation of the company in July 2016. At the time of liquidation of the company, its shares were bought back by shareholders as per the value listed:

· Sachin Tendulkar (9 shares): $856,702

· Anjali Tendulkar (14 shares ): $1,375,714

· Anand Mehta (5 shares) $453,082

The average buyback price of shares of Saas International Limited is around $96,000. The company’s resolution dated August 10, 2007 (the day the company was formed) shows 90 shares of the company were issued at the outset. Anjali Tendulkar got the first share certificate with 60 shares; her father got the second share certificate with 30 shares. While there are no details of buyback of the remaining shares, the value of 90 shares can be pegged at $8.6 million (roughly Rs 60 crore).

The date of liquidation of Saas International Limited is also significant as it came three months after the Panama Papers expose. In Alcogal spreadsheets, Sachin Tendulkar and Anjali Tendulkar also figure where they are categorized as Politically Exposed Persons (PEPs). In one registry of PEPs, Sachin Tendulkar is listed on account of him being an MP and is put in the “high risk” category. Another review of Sachin Tendulkar and Anjali Tendulkar’s PEP status was done in May 2016, two months prior to the winding up of Saas International Limited.

Sachin Tendulkar’s tenure as a nominated Member of the Rajya Sabha was from 2012 to 2018, and for four of these years, his BVI entity was registered and running with Alcogal. As per regulations, nominated Members of the Rajya Sabha are not required to submit their annual list of assets and liabilities as other elected MPs need to.

The shareholders’ resolution for dissolution is signed by all three of its shareholders: Sachin Tendulkar, Anjali Tendulkar, and Anand Mehta. As per regulations of the Mutual Legal Assistance (MLA) Act, 2003, there are also details about where the “location of records and underlying documentation” for Saas International Limited will be after its liquidation. The certificate, dated July 15, 2016 (the day the liquidation was initiated), shows that the records would be maintained by LJ Management in Neuchatel, Switzerland.

Pandora Papers Expose Offshore Dealings Of Anil Ambani, Jackie Shroff, And Other Famous Celebrities

The former cricketer, his wife Anjali Tendulkar, and his father-in-law Anand Mehta have been named as Beneficiary Owners and Directors of Saas International Limited, a company based in the British Virgin Islands. The company was reportedly liquidated three months after the Panama Papers expose.

Mrinmoy Mukherjee, the director of Sachin Tendulkar Foundation, said that the investment was legitimate and was declared in the former cricketer’s income tax returns. He said that there was no question of him engaging in money laundering or tax evasion.

The ICIJ analysis of the secret documents identified 956 companies in offshore havens tied to 336 high-level politicians and public officials, including country leaders, cabinet ministers, ambassadors, and others.

Besides Sachin Tendulkar, the ‘Pandora Papers’ also expose offshore dealings of Reliance ADAG boss Anil Ambani, Purvi Modi, sister of fugitive diamantaire Nirav Modi, John McCallum Marshall Shaw, a British citizen and the husband of Kiran Mazumder Shaw, Bollywood actor Jackie Shroff and corporate Lobbyist Niira Radia.